In response to the pandemic, the Federal Government has temporarily increased the JobSeeker payment by $550 per fortnight for both existing and new recipients, effectively doubling the current rate. This Coronavirus supplement will come into effect from 27 April 2020, and will remain in effect for six months. In the short term, Centrelink has also made other changes to make their payments more accessible to those affected, including waiving their liquid assets test, which means that you will no longer need to burn through your savings before becoming eligible for payments.

This is welcome news to the thousands of freelancers and sole traders, who have been left in the lurch after arts events were cancelled nationwide in response to COVID-19. As social services continues to update their response to the crisis, we have put together a guide to navigating the Jobseeker payment claim system for sole traders, in order to shed some light on a system that can be opaque from the outside. Throughout the next few weeks, we’ll be publishing regular stories on Governmental support available for artists, sole traders, and freelancers, as well as guides on navigating the Centrelink system.

Where do I start?

The easiest way is by registering your intent to claim online, through the MyGov website. You don’t need to have linked your account to Centrelink to complete this step, but you will need to do so to fill out and submit a full claim. You no longer need to attend an in-person meeting to be eligible for payments; the entire process can be carried out online. Applicants are discouraged from attending online appointments, in favour of online applications.

If you are currently overseas, you can still access your MyGov account, provided you are able to receive text messages to the number associated with your account, which will be used for security purposes.

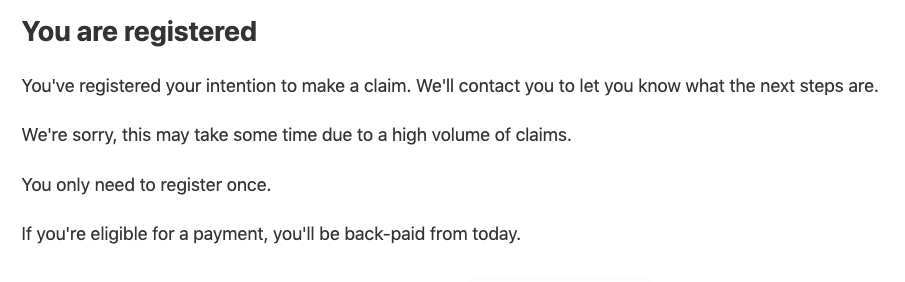

Registering your intent to claim only takes two clicks, and then you should receive this message:

This means that even if there is a delay on submitting or processing your claim due to high traffic in the Centrelink system, it won’t affect the commencement date of your payment. Your payments will be backdated to the date that you registered this intent to claim. From here, you will receive further instructions via email in the next few days.

What can I prepare ahead of submitting my claim?

After you’ve submitted your intent to claim, you may have to wait a little while before submitting your claim itself, as the system works to accommodate a sudden increase in need. That doesn’t mean you can’t be prepared, though; you can apply for a customer reference number (CRN) through Centrelink, which will help you manage your payments and services, and you can prepare the forms you will need to submit to support your claim.

How do I apply for a CRN?

A CRN is a string of characters comprising 9 numbers and ending with a letter. This is how Centrelink identifies each person’s personal record. You will need a CRN to set up a Centrelink online account, which is how you will keep track of your payments and the services you are using, as well as receiving updates from Centrelink as their programs continue to respond to the crisis.

If you have applied for Centrelink assistance before, you’ll be able to find your CRN on any letters they have sent you, or concession cards you might have used. Your CRN doesn’t expire, so if you find a letter from an old payment you no longer receive, or an out of date concession, that CRN will still count.

If you don’t have a CRN, or can’t find a record of your CRN, you’ll have to call the Centrelink online accounts number on 132 307 between 7am-10pm Monday to Friday, or 10am-5pm on the weekend and public holidays.

How can I prove that my income has been affected by coronavirus?

You don’t need to provide any medical certificates, or prove that your business has been affected by COVID-19 specifically. You will be asked to complete an income test, and to provide statements about your business’ profits and losses over the last financial year, and the last three months.

What forms will I need to prepare for my claim?

When the Coronavirus supplement comes into effect on 27 April 2020, sole traders applying for Jobseeker will no longer be asked to provide Employment Separation Certificates, proof of rental arrangements, verification of relationship status, or a list of assets. Your eligibility will be based on your income, not your savings.

If you apply before 27 April, the list of supporting documents you will need to prepare is as follows:

- Evidence of your account balance covering the three months prior to and including the date you are submitting your claim. This must include BSB, account number, and account holder names for all accounts, including joint accounts. A bank statement will be accepted, but an ATM slip will not.

- A list of the type and amount of each asset and liability of your business

- A profit and loss statement for the previous financial year for your business

- Your latest personal tax return

- Profit and loss statement for your business since income change, or over the last three months, whichever is longer.

- As a supplement: proof of your lease or rental agreement.

How long is the waiting period? What if I’ve just moved to Australia?

Centrelink has waived their ordinary waiting period, as well as their newly arrived residents waiting period. This means that eligible Australian residents will not experience a formal waiting period for their payments.

Australian residents who recently moved to Australia no longer need to wait 2-4 years to access most of Centrelink’s services, including the Jobseeker payment. For all applicants, the obligatory one week delay on new payments, called the ordinary waiting period, will no longer apply.

My income hasn’t been affected yet – but it might in the future, as the creative industries slow down. Would it be wise to apply now?

If you’re concerned your income may be affected in future, you should begin tracking and gathering the documentation you would need to submit to a claim, such as your business’ profit and loss statements. This way, you can register an intent to claim as soon your situation is becomes more clear, and rest assured that you are prepared to submit your claim.